Busy. That’s the new norm. And busyness would always result to burn out or the feeling of being drained inside. I know how it feels. Ramdam ko kayo mommies, juggling the roles of a wife, mother (without a househelper), managing a small business plus part-time job as a...

Money Matters

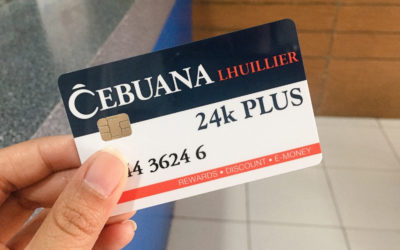

P50 to open a micro savings account at Cebuana Lhullier

Alam nyo ba mommies na may mga nag-iipon pa rin sa arinola, sa panyo at sa ilalim ng kama?Ayan ang mga #savingtipnilola ko noong bata pa ako at surprisingly until now ay may mga nagawa pa rin ng ganyang ipon style.Pero bakit nga ba marami pa rin nagawa nyan kahit...

What not to do with money?

We all can agree that money is a good tool. A good tool to achieve dreams, it helps us buy the things we need and even want, a very good tool to help other people as well. Sabi nga nung napakinggan ko noon, “Plastic daw” (ang-harsh!) ang magsasabi na hindi kailangan...

Christmas Budget Planner (Free Printables)

Are you preparing for your Christmas list? Thinking of meals to prepare for the family… Gifts to bless your loved ones and friends… Let’s make it a little more organized mommies, into a one-page Christmas Planner. My husband helped me designed this printable...

Do “stay-at-home-moms” need life insurance?

“I’m just a stay-at-home-mom” “Full time mom lang ako” Huwag natin sabihin na “lang” ang pagiging isang full-time na housewife at nanay. If you’re a stay-at-home-mom you are the: A stay-at-home mom should more or less get around P70,000 monthly salary. So do you think...

Meaningful Ways to spend your Christmas Bonus

Welcome ber months! Its the busiest season of the year. And for us Pinoys, sobrang haba ng ating Christmas celebration. Nakaka-excite kumain ng puto bungbong, makinig ng mga batang nag cacarolling or maglakad lakad sa malamig na weather. But ofcourse, ang most awaited...

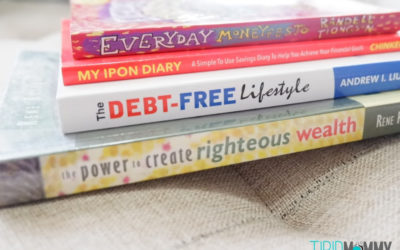

Tipid Mommy Finds: My Favorite Financial Literacy Books

On our family's journey to financial freedom, aside from investing on workshops and mentoring, we're also investing on good books. Reading became one of my favorite me-time as a mom. Kung nababasa nyo na ang blog na ito mommies, you know that our family been through...

Mga dahilan bakit hindi tayo makaipon

Mommies, natanong nyo ba ito sa sarili ninyo? Bakit tuwing January sobrang excited tayong maka-ipon, parang “this is it” “this year we will save money” pero kapag June na, kahit singko, wala tayong na-save… Ouch! Share ko lang ang mga usual na dahilan or reasons bakit...

How to build the habit of saving and investing?

Naalala ko yung part ng book ni Coach Chinkee Tan, na mas madali pa mag-ipon ng taba “bilbil” kesa sa pera. Aruy! Di ba? Funny but true naman. Minsan, sobrang excited na tayo mag-save pero patapos na yung month, hindi man lang tayo nakapag set aside ng money for...

Sino ba dapat ang mag-budget? Si Mister or Misis?

Si Mister or si Misis? I am sure natanong nyo na ito Mommies. Sino ba talaga ang dapat na mag-budget? Mag-handle ng payment sa bills? In short, who should handle the family’s finance in every home? Magandang question yan mommies. Because it means you are trying to...

Error: API requests are being delayed for this account. New posts will not be retrieved.

There may be an issue with the Instagram access token that you are using. Your server might also be unable to connect to Instagram at this time.