Almost everyone I know, experienced financial crisis and stress in some point of their lives.

Lost their job, business failure, investment scam, debts and a lot more.

My husband and I have experienced financial crisis, not just one from above event list but all of them, yes. Financial problem after another. (That wallet is our living evidence hehe.)

On our attempt to build a steadier income, we’ve ventured to different businesses, But not all went well, after few years of operation we’ve decided to close our small salon business, then we’ve been scammed by someone who manages our permits and left us with piled up government penalties, my husband’s freelance job got off season too during that time.

So imagine kung gaano ka-stressful iyon for us not to mention that we are just starting our family (I just gave birth to Zee) that time.

Here are some of the things that helped us survive during our financial crisis:

- Tap to the Real Source

During financial crisis, our business closure and job loss, there is one thing we’ve realized, these resources are all temporary. Jobs and Businesses are just God’s channels but He is the blessor behind it, He is the real Source. So we’ve decided to live in faith that even though it doesn’t look clear yet, we hold on to God that He will provide and restore everything we’ve lost.

“Look at the birds of the air, that they do not sow, nor reap nor gather into barns, and yet your heavenly Father feeds them. Are you not worth much more than they? Matthew 6:26

- Discuss the Family’s Financial Situation

Open communication with our spouse, even with our children who are old enough, about the current financial situation. So each family member will understand some lifestyle changes and even help in coming up with a solution.

- Strategize and Start a game plan

After discussing the situation, come up with a solution or a plan, how to increase the income? what side business or work we can start? What are the important expenses in the family? What debts need to be settled first?

“Remember we cannot control the circumstances in life but we can control our attitude and response to our circumstances”

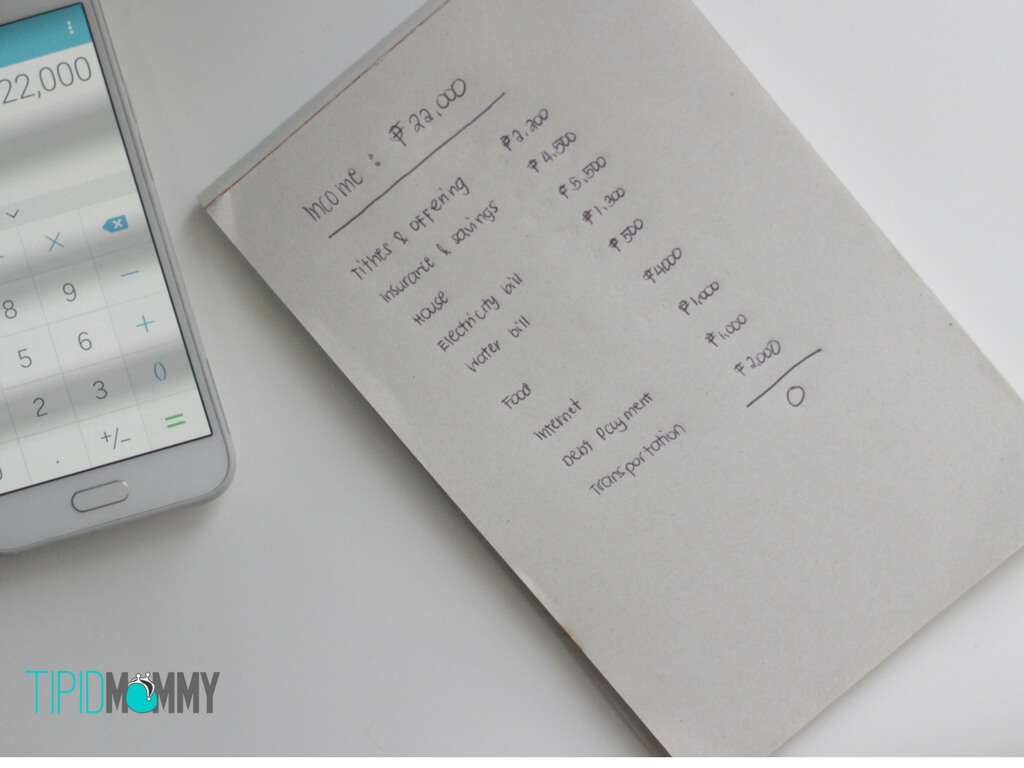

- Create a Budget

If you do not have a budgeting plan yet, you need to start creating one especially during a financial crisis.

The Zero-Budget Rule of Dave Ramsey helped us a lot.

Let’s say P22,000/month ang income ng family kailangan i-assign ang every peso and walang matitira na walang assigned expense or saving designation. This is to avoid overspending or spending in wrong category.

- Downgrade Lifestyle

This maybe one of the most painful part of facing financial crisis, to downgrade our comfortable and “nakasanayang” lifestyle.

I know how hard this part is, but we need to really classify our wants and needs.

Check out the unneccesary expense that your family have. In our case, cable tv, eating out, postpaid subscription and a lot more. Ilan months kami di nag-mall at kumain sa labas noon.

(Read: Simple Steps to Frugal Living)

- Sell pre-loved items

One of our strategies is to earn from our pre-loved items. We took an inventory of the items we can let go and sell for a cheaper price. It became a blessing to someone and a big help to our financial situation too. Our earnings went to debt payment and for our monthly budget.

- Check what you still have

Skills audit! Write down all your skills, what skills can you offer online? What part-time job can you try? What business can you operate from what you have? Those are the questions we’ve asked ourselves.

We saw our dusty printing equipment so we started selling t-shirts and clothes online again and it really helped us a lot.

(Read: Why I am still thankful going through “not so ok” financial season)

- Never compare, never blame

In this social media era, where in we can see our friends or schoolmates post online – personal achievements, new car, new home, the latest gadgets and their family vacations. This can make us feel bitter and we can even feel “self-pity” during financial crisis, but let’s guard our hearts against any bitterness and be happy for others instead. Besides, we also do not know the behind the scene sacrifices and hard work they faced in order to achieve those things.

As the famous quote say “comparison is the thief of joy”

- Ask and accept help

During the lowest point of our lives, we also learned to be humble, we asked tips and advises from different people. Kahit hindi naman monetary help talaga, other people’s wisdom and practical tips can help a lot.

We will be forever thankful for the people who shared advices and tips to our family during our lowest point. (These are our Church Leaders, Friends, even Mr.Chinkee Tan & Ms. Christine Bersola-Babao)

- Stay grateful and never lose hope

Financial crisis lessons can either bring out the best in us or rob us deeply.

Let me share with you a story I’ve heard,

There were two prisoners on a cell, one night, the other one is looking at the bars and accepted that he will grow old and die there inside the cell, while the other one is looking at stars outside the bars believing that someday he will go out and start a new chapter with his family.

By counting our blessings, staying grateful for what we have and keeping our faith that the financial crisis will just be a temporary season and just a test of character, we will never lose hope that brighter days are yet to come.

Are you currently facing a big financial crisis? Or have you overcome one? What additional tips do you have for others who are facing financial crisis and stress right now?

yes to selling preloved items.. been helping us a lot!

True, may hidden treasure pala tayo sa bahay ano? (hehe)

nice tips mommy.,dun sa ask and accept help…lately i have a friend who went through a lot at ako bilang kaibigan i offer a little help but in my surprise tinanggihan ni so called “friend ko” yung help ko in a rude manner…rude kasi po i was offended how she react sa binibigay kong tulong so i guess hindi po lahat ay open sa pagtanggap ng tulong.

Love the story of the two prisoners. I agree on the never blame and compare. Often, it’s the comparing that saddens us, blaming others for their success and for our downfall. When in fact, they did nothing wrong but strive hard.

Agree, when we start comparing and blaming, nag-start din tayo mag self-pity ano? and lalo lang nakaka-depress.

I agree with downgrade lifestyle, we did that when I resigned from my work. Living on a single income is not easy so we have to adjust our budget. I changed my postpaid plan, canceled our internet connection and stopped traveling. Tiis lang sa umpisa hanggang makaraos. 🙂

I love it mommy, ang galing mo, it is hard to live on a single income di ba? I made a post about that #thestruggleisreal 🙂

https://tipidmommy.com/financial-steps-to-be-a-stay-at-home-mom-2/

Hi michi! Tanong ko lang. How are you able to cancelled your internet connection and changed postpaid plan? Did you pay for pretermination costs? Thanks. 😊

Thanks for sharing all these tips. I agree na there are times talaga na trying and we have to look up to the source. I find tithing a good way of being blessed. Even though the income is low, but when you tithe, parang everything falls into place.

I agree to what you’ve said, when we Put Him First, everything is in place.

It is through our financial crisis na nakita namin totoo pala na mag sow ka ng seed kapag in need ka and keep the faith lang! 🙂

“Remember we cannot control the circumstances in life but we can control our attitude and response to our circumstances” This is true, our attitude towards life will help us overcome challenges in our life. When I was I kid, our family survived financial crisis by downgrading our lifestyle. I remember buying new clothes and shoes every start of the school year, then suddenly, we adjusted our lifestyle. Mahirap talaga pag simula, but then we have survived.

Aww! mga kids talaga ang makakaramdam ng sudden changes ano? But by having an open communication children can understand na “season” lang, and look at you know sis, di ba na-share mo madaming lessons ang natutunan mo from that experience. “this too shall pass” talaga ano mommy? 🙂

Agree with everything! Such strong and helpful points. Thanks for this reminder. I’m sure this will be very helpful to a lot of families who are just starting out. 🙂

Thank you Mommy Abby. Praying it will help families especially ang mga nag-fi-face ng Financil Crisis of any kind.

I never knew there’s a term called for the thing I’ve been doing for years: the Zero budget rule, but yes, that’s what I’ve been doing. The downside to that is in between paydays, talagang meron akong mga unexpected gastos na wala sa budget, lol. So what I do is I borrow from the savings and then pay for it come the next payday.

I can relate..I just survived ….I came out from that “financial crisis” and restarting :). It was just last September 2017 when I lost my freelance work. Come October 2017 my mother-in-law who lives with us was sick (she was in comatose for 10 days). What I have is my skill but for some reason, I don’t get any new project at all. Almost 2 months of going through the storms of life, losing a job and death of my mother-in-law, it was not just financial crisis may kasama pang emotional crisis but I am just in awe what God has been doing in our life. You will really realize who is really your source…just in one day, when we are busy looking for almost Php85k for the bill, we paid nothing and got a new freelance work.

Thank you Ms. Gracie. Indeed, never tayo pababayaan ni God. Magtiwala lang tayo. And think of ways para maka survive.