Naalala ko yung part ng book ni Coach Chinkee Tan, na mas madali pa mag-ipon ng taba “bilbil” kesa sa pera. Aruy! Di ba? Funny but true naman.

Minsan, sobrang excited na tayo mag-save pero patapos na yung month, hindi man lang tayo nakapag set aside ng money for savings.

Tapos kapag may dumating na need or opportunity, manghihinayang na tayo na hindi ‘man lang tayo nakapag save or set aside for it.

Don’t worry, I feel you mommies. Hindi naman kasi talaga natural saver ang lahat sa atin, even our family, we’ve failed many times in saving money before. Until situations and financial lessons woke us to take saving money seriously.

I’m excited to share with you some of the tricks and tips we can do mommies to build the habit of saving money:

- Its okay to start saving in small amounts

I agree na dapat atleast 15% of our income ay napupunta sa savings pero when you’re just starting out this new habit, ok lang mommies kahit mas maliit sa exact 15%. Example P1,000/month, mas ok pa rin yun kesa wala right? Small progress is still progress.

Once we get the rhythm of saving money, mas madali na sa atin mag-add ng amount, and we’ll be surprised baka more than 15% na pala ng income ang natatabi natin di ba?

That’s why I believe, that its okay to start in saving small amounts, just do it regularly.

- Set aside the saving part first before the expenses

View this post on InstagramHow do you budget inays? As a family, we are using this formula 🙂 #moneymatters #budgeting #finance

This is our current finance formula, after ng tithes and offering, bago gumastos, we made sure we allocated the money for savings. Sinubukan kasi namin noon na after nalang mag-bayad ng bills, every end of the month nalang, madalas ang ending ay wala or sobrang liit nalang. Yung plano namin pang-save, napunta sa eating out, or bagong blouse.

Kasi habang nasa wallet sya or ATM for our expenses fund, feeling natin marami pang pwedeng gastusin. Di ba?

Pero kapag nabawas na muna si savings , no matter what happens, mapapagkasya na yung natira for expenses part.

- Take advantage of auto-debit savings and investment options

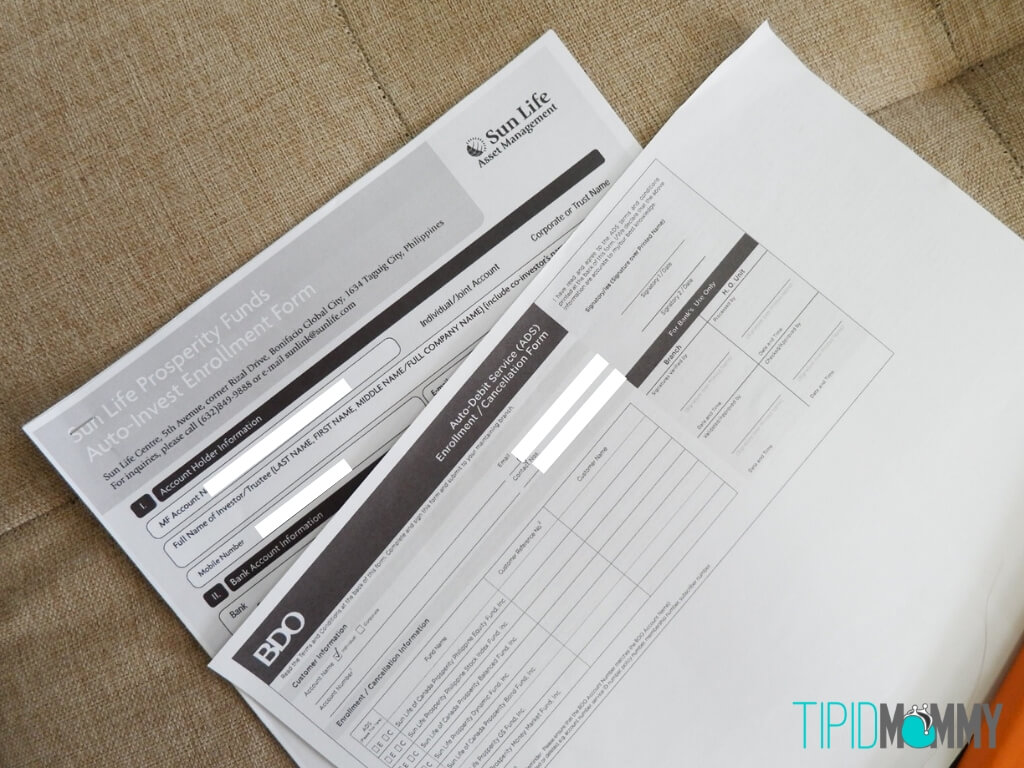

Most banks, insurance companies and financial institutions are now offering auto-debit or auto-invest service. Yung automatic na ibabawas sa bank accounts yung amount that you’ve set aside for your savings or investment.

(Read: Preloved Baby Items to Mutual Fund Account)

That’s one of the financial goals that we committed to do this year, that’s why we’ve scheduled a meet-up with our financial advisor Ms.Che and enrolled our son’s mutual fund to auto-investment program of Sun Life.

I highly recommend investing in mutual fund especially for newbies in investments. Because instead of us managing our investment in Stock Market, may fund managers na well-trained sila na mag-mamanage ng accounts natin.

Kahit small amount lang yun monthly, we’re sure na mas ok yun compared kung tuwing may extra lang kami maghuhulog, sabi nga ng financial experts, take advantage of the time. At sa savings and investment, we all can agree that the best time will always be today di ba?

So ayan mommies, I really hope that these tips can help you to build the habit of saving money in your family.

With discipline, focus and determination to achieve our saving goals, we can build the right habits of being a saver.

What about you mommies? May additional tips pa ba kayo and hacks? Would love to hear from you…

I agree with start with small amounts hanggang makasanayan na. Kaya habang bata pa dapat marunong ng mag-save para pag nagstart na sila magwork, madali na sa kanila magbudget. 🙂

I agree, isa talaga ang money values sa dapat natin maituro sa ating mga kids 🙂

I admire your budget formula, mommy!

Great tips, mommy! I’ve heard lots of great things about Sun Life that I’m also considering investing with them. 🙂

Yes, plus their financial advisors are very accommodating too 🙂

Agree na yung auto debit na investment or savings really work. I have one sa office. So automatic ng inaalis. Hehehe!

Yey! Hassle-free pa di ba mommy? 🙂

Yes, super agree to start with small savings. Summing everything up, you’d end up with a good amount then bigger and bigger as years pass by

I first learned this principle from our mentor, Yeng Remulla. It’s how it should be talaga.

Practically speaking, pag inuna mo ang expenses, mahihirapan ka nang mag save or magbigay sa tithes, kasi feeling mo wala nang matitira sa yo. But if you prioritize your tithes and savings, tipid ka na sa expenses, hehe.

Tama ka sa autodebit. It helps me a lot not to forget to save first every month. Sana may app na we can easily use and secured at the same time which will automatically save our money every sahod, in whichever bank we want to deposit. Yung automatic na talaga. Sana may ganun.

I agree sa mga tips mo dito. Mas madali nga magsave kahit pakonti konti lang & yes pati auto-debit savings para nakaschedule ma rin.

We are still on the starting part of saving and I believe we can make it habitual na rin in time.