Have you heard about Coach Chinkee Tan’s Moneykit?

Moneykit is a money management system in a box that will help every Filipino to:

- Save

- Budget

- Get-out of Debt

- Invest

The term “budget” is overly used in every Filipino Family’s home.

Si Nanay pa lang palaging sinasabi “Wala pa kaming budget para dyan…” But as I observe wala na

man talagang budgeting plan and only few people really do have a budgeting system.

Our “budgeting” background

Maybe because I started working at an early age, that experience helped me be a budget-conscious person.

My husband often told me how blessed he is for having me and for being a “low maintenance wife” haha!

Everything is recorded, even Php 5 peso na mani sa kanto ay recorded… haha!

Thank God for the wisdom in handling finances, we are able to save up and started investing even before we got married.

BUT…….

when I gave birth and became a mom, everything changed. I lost tracked.. I wasn’t able to record our expenses for almost 2 years because instead of recording our expenses I would rather catch up some sleep and rest. (Buhay nanay/negosyante without a yaya.)

Our budgeting and financial management were all messed up. (Newbie parents, I know you can relate! :))

Not to mention having business hiatus and husband’s job went off season during that time.

We overspent, we got scammed and even accumulate some debts that time, our savings were down to zero. I remember those days that I am pulling out our investment so we can pay our house mortgage, those days that we lost almost everything, those days are painful days that my husband and I lifted to God and prayed it won’t happen again in our family.

Thankful and amazed on how He is restoring everything little by little.

As they say, “Money is an acid test of a person’s character” as a couple, we made a decision that we wanted to honor God even in the area of our finance by being good stewards because in the first place, we are not the owners of these resources but only managers.

If you can relate to our story, Moneykit can also be your family budgeting buddy.

We humbled ourselves and asked for help from the experts. Coach Chinkee Tan personally gave our family a “Moneykit” when they had us as guests on their show Moneywise.

Here are the things included inside the kit so you’ll have an idea:

1. Accordion Envelope – helps a lot, it gives us a boundary or dead-end in each categories of our spending. Before, even we have a budgeting plan, our budgeting plan adjust to our lifestyle instead of our lifestyle adjusting to our plan.

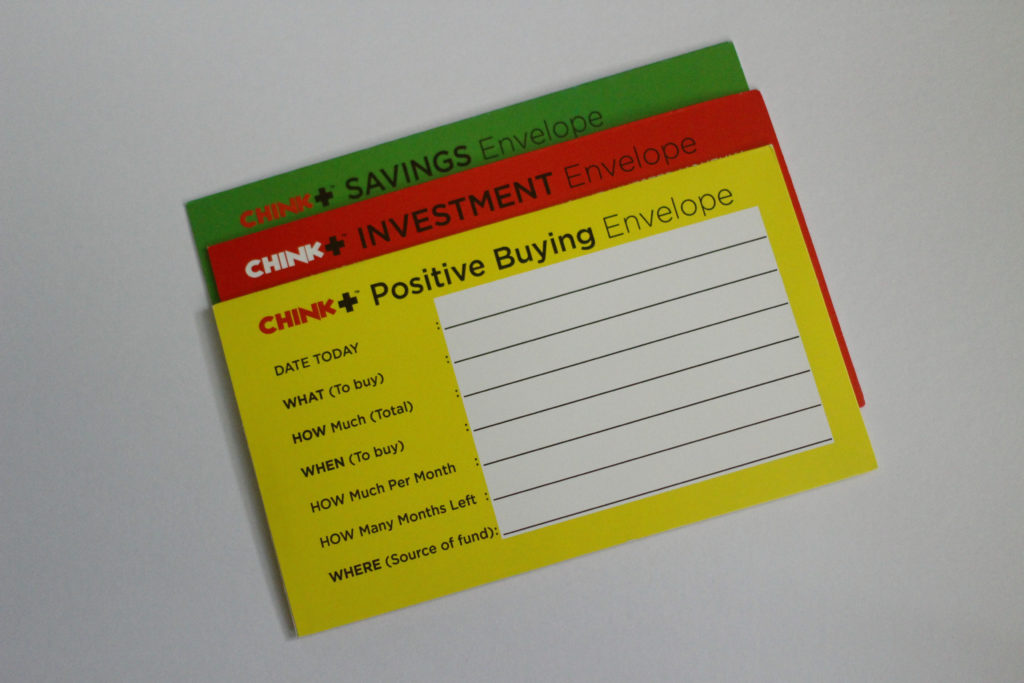

2. “THE ENVELOPES”

(Positive Buying Envelope)

It gives freedom to celebrate without guilt.

We’re using this envelope to save up ahead to our family travel without using credit card and just paying things we want in cash.

For example, if you wish to buy a new pair of shoes worth PHP 3,000 you can allocate a budget per month to save up for that dream item and even set the “shopping day” for the item. This envelope helped develop our patience and not be an impulse buyer.

(Investment Envelope)

It’s where you put the budget you allocated for investment – stocks, mutual fund, real estate and insurance.

(Savings Envelope)

An envelope for the savings fund. Most of us thought that saving money is only for people who are earning more than enough, but when we deduct the savings ahead before we even spend all our money, even Php 250/ week can help us save Php 12,000/year.

3. Financial Obligations Worksheet

This worksheet helped us identify our needs vs. our wants. Surprisingly, I found out that our food cravings during midnight are part of “wants” because we will not die if we don’t eat ice cream at 12 A.M haha!

4. Expenditure Envelopes

These envelopes helped us track our expenses and alarmed us if we are near our boundary per category.

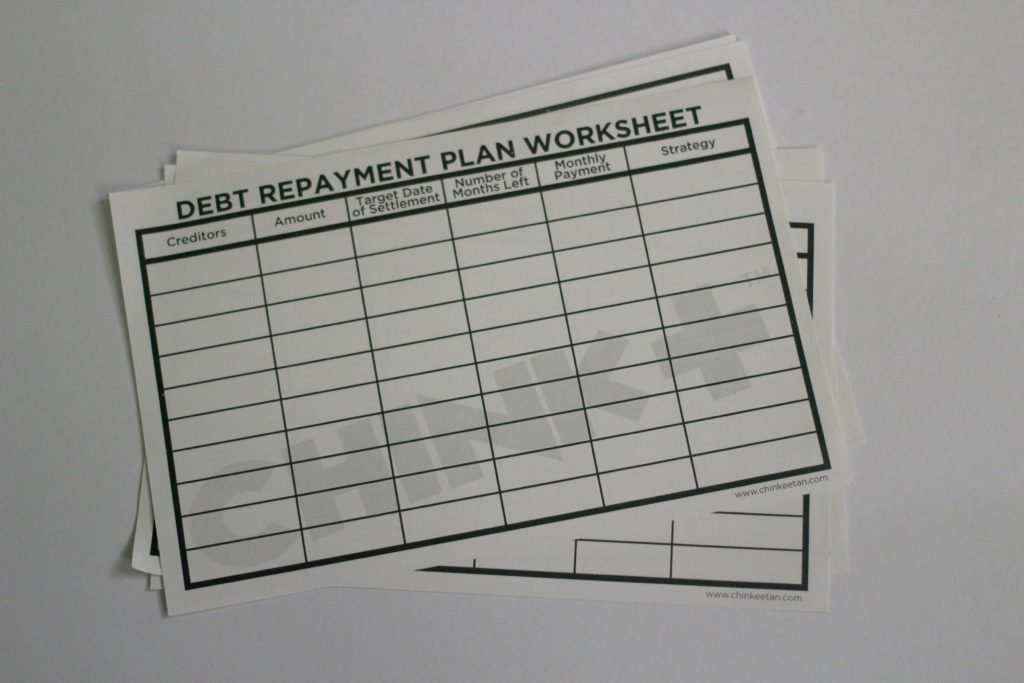

5. Debt Repayment Worksheet

This part is great for making strategies on how to pay-off all debts. As Coach Chinkee said, an important step towards financial freedom is “to be debt-free” first.

6. Software

The Moneykit also include an access to Money Kit Software that will help us keep track of our finances.

7. DVD Guide

A Video guide by Coach Chinkee Tan, a step-by-step guide on how to use each part of the Money Kit. it is like having him as your personal mentor at home.

8. Till’ Debt Do Us Part Book + more!!

He also included his best selling book. WOW!

And if I am not mistaken, Coach Chinkee is including more of his books when you purchase “Moneykit” online now!

Again, we are still in our financial freedom journey, we are not experts in family finance, but we decided to take a step.

And we are happy to share our small progress and tips that helped us in this journey.

Is budgeting good? or a waste of time? This verse says it all.

The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty. –Proverbs 21:5

0 Comments