Alam nyo ba mommies na may mga nag-iipon pa rin sa arinola, sa panyo at sa ilalim ng kama?

Ayan ang mga #savingtipnilola ko noong bata pa ako at surprisingly until now ay may mga nagawa pa rin ng ganyang ipon style.

Pero bakit nga ba marami pa rin nagawa nyan kahit modern at marami ng development sa financial industry?

Ito ang ilan sa mga dahilan:

1. Marami masyadong requirements na wala ang normal na Filipino

2. Mataas masyado ang maintaining balance

3. Malayo yung banks sa area nila especially sa nga rural areas

Only 33% or 551 cities in the Philippines have access to banking institutions. No wonder na isa talaga ang lack of bank nearby sa barrier ng pag open ng bank account ng ating mga kababayan according to BSP study.

Thankful sa newly launched product ng Cebuana Lhuillier “the Cebuana Lhuillier Micro Savings”. It will help more Filipino Families to start the habit of saving, yes simple filipino families can now save!

One valid ID lang and a miniminal P50 initial deposit you can open an account na. Plus 2,500 ang branches ng Cebuana! Kaya makaka-withdraw anywhere, convenient especially sa mga rural areas na wala pang mga bank establishment.

UY! MAY ONLINE BANKING DIN!

Para mas ma-maximize at usage ng micro savings… Cebuana Lhuillier will also be launching its very own eCebuana app which allows micro savings users to check their balance, makapag send ng remittance, load and even pay bills online.

Hassle-free saving and even doing other transactions online di mommies? Especially sa mga moms na walang helper at hindi makaalis ng bahay, big help ang mga online transactions like this.

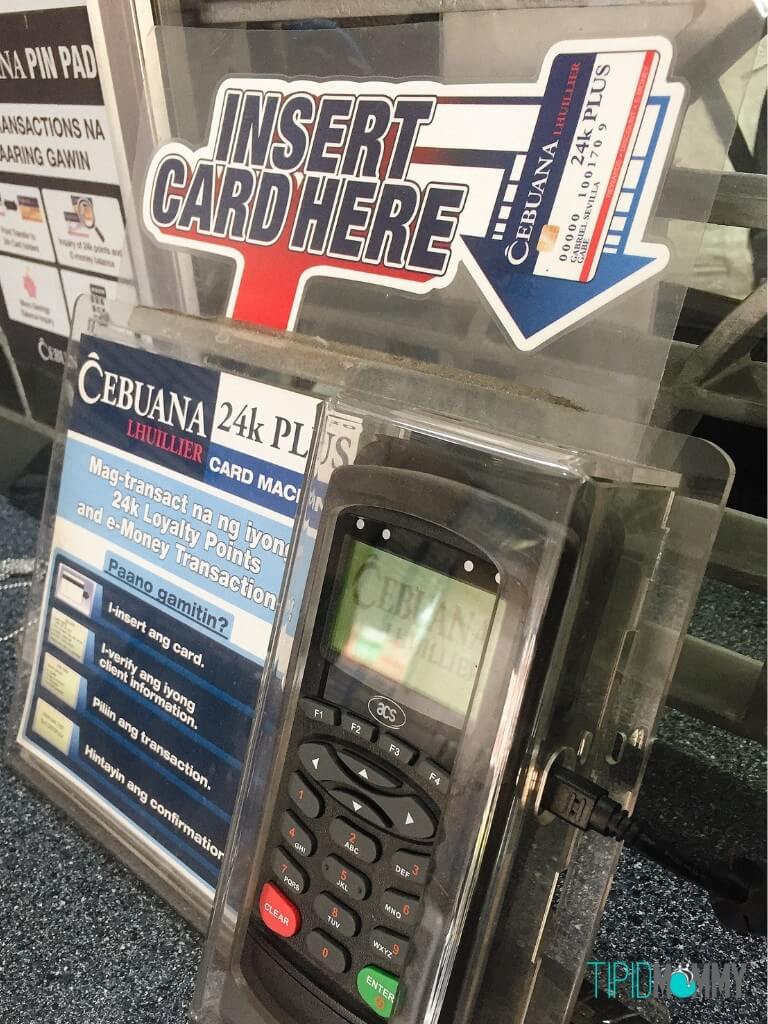

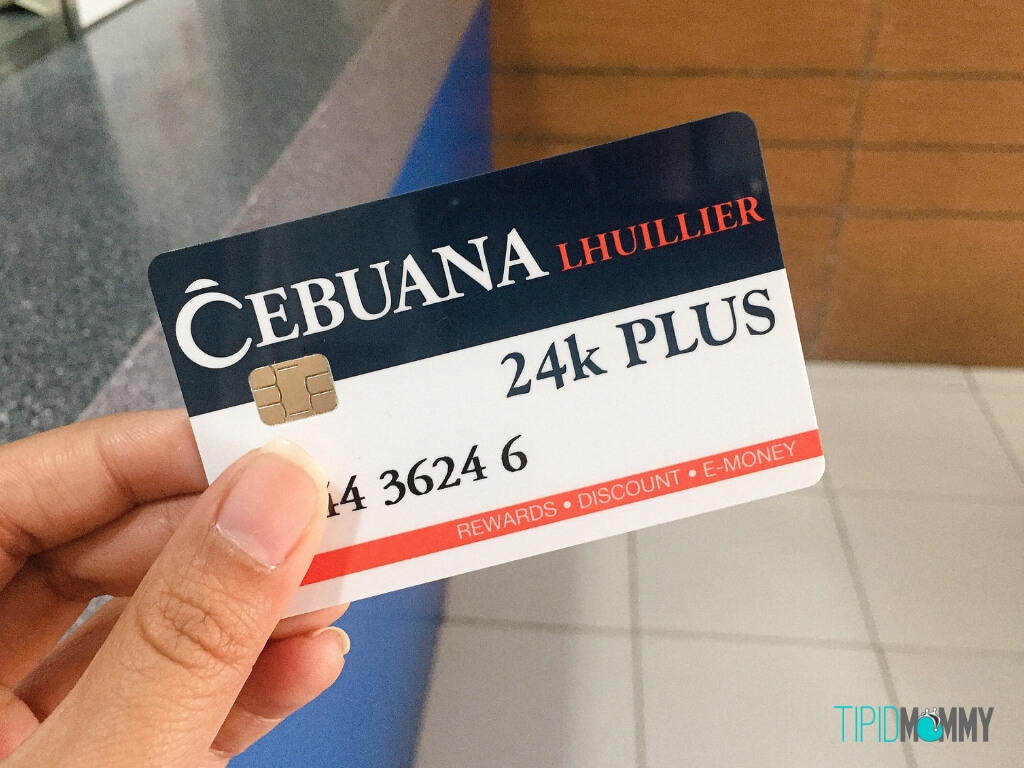

EMV-CARD DIN!

And like other emv-enabled card pwede rin sya magamit to shop cashless. If mag-grocery ka pwedeng i-debit nalang sya. Small businesses can also use it as payroll cash management solutions for their employees. Naisip ko nga pwede din sya payroll para sa mga may helper or driver di ba? Para maturuan din sila mag-save ng pera.

Cebuana Lhullier President & CEO Jean Henri Lhullier’s vision on financial wellness.

“Cebuana Lhullier is also adapting a new philosophy, why is financial wellness. Our goal is not just to provide quick cash to underbanked and unbanked for their short-term financial needs but to become an enabler for a better future for them. Allowing more and more Filipinos to steer their own direction and be captains of their own ship. We want to help them graduate from being dependent through bridge financial options for them to experience financial freedom”

Nakakatuwa ano mommies, na bukod sa pwede ka mag-pawn or “sangla” ng jewelries sa Cebuana para masolutionan ang urgent financial matter, nakakatuwa na isa sa advocacy din nila na hindi lang masolutionan ung current need ng mga kababayan natin kundi matutunan din ng maraming unbanked Pinoys ang value ng saving. Long-term thinking na!

Indeed #KayaNa! Unbanked Filipinos No More Movement!

Kahit simpleng tao pwede na mag-open ng bank account, hindi na issue ang lack of bank dahil maraming branches ang Cebuana. At grabe, P50 lang ang minimum para makapag open. Minsan napupunta lang yan sa merienda di ba?

What ID’s are accepted?

Alien Certification of Registration

Birth Certificate (for minors only)

Barangay Certificate or ID (signature and photo)

Company ID

Driver’s License

DSWD certificate

GOCC ID (Afp, HDMF-Pagibig, Philhealth)

GSIS E-Card

IBP

Immigrant Certificate of Registration

NBI Clearance

National Council for the welfare of disabled persons

New TIN ID

OFW ID

Passport

Police Clearance

Postal ID

PRC ID

Seaman’s book

Senior Citizen’s ID

SSS ID

Student ID

Voter’s ID

Firearm license

Marriage license

How to apply?

Just approach the guard or their staff for the form. Present one valid ID.

How much do I need to pay?

If you do not have the Cebuana 24K card yet, pwede kayo mag-avail for P100 then kung magkano ung idedeposit nyo. If meron na kayong 24K Card, kung magkano nalang yung amount na idedeposit nyo.

(Example P100 for the 24K card + 50 your initial deposit = P150 lang)

Nag-eearn din ba ng interest?

Yes! 0.30% minimum balance of P500 para mag-start mag earn ng interest.

May maintaining balance ba?

Waley Mars kaya ok na ok

May charge ba magdeposit and withdraw?

There are no transaction fees for cash withdrawal and deposit.

Upto 3x per day allowed withdrawal. Upto P50,000 naman ang maximum cash deposit.

Pwede din po ba to maka.recieve ng remittance from abroad?

How much fees if buy a load…..

I’m planning to get one Sana, yung mismong 24k plus card iyon na ba yung para sa savings? How about yung kapag ginagamit mo sya for remittance then nag e earn Ng points, iba pa ba Yun? Thank you! 😊

Hello, bakit po yung card ng iba ay may name nila sa 24k Card nila at ang iba naman ay wala? Ano pong pinagkaiba nun? Also, natry niyo na po ba yung eCebuana app? If yes, how was your experience?

Thanks

oo nga yon din sana hinahanapan ko ng sagot hindi naman kasi same customer digit number yong may name at walang name tas hindi ako maka successfully register sa cebuana app.