Do you have goals especially “financial” goals for this year?

As a mom, wife, freelancers or small business owners we have goals in different roles and hats that we have in our lives.

I’m sure we all have goals that doesn’t have any equivalent amount of money but we also have goals that comes with a price tag..

Have we ever thought of how much our goals really cost?

As most people shared, our goals should be measurable and time-bound.

There many goals in my life na hindi ko na-achieve, na-realized ko goal langs kasi sya pero wala akong action steps… parang itong scenario hindi naman pwede ang architect gagawa ng bahay without first having a blueprint ng bahay at costing ng overall expense. Right?

Anong possible mangyari if hindi magcocosting ng tama?

“Matitigil ang construction ng bahay”

1. Same with our goals, as I’ve mentioned earlier our goals should be measurable, we need to determine how much is the total cost of our certain goal.

Example, you want to have a family vacation next year on your child’s birthday, how much will be the total cost of your vacation?

(Read: How we used our paluwagan savings for our family vacation)

Another example goal is being “debt-free this year” you need first to know how much ba total debts na dapat mong bayaran..

2. Then.. after knowing the Goal Cost, it is time to set a deadline and compute how much you need to set aside in the budget per month for you to achieve the goal on your specific deadline.

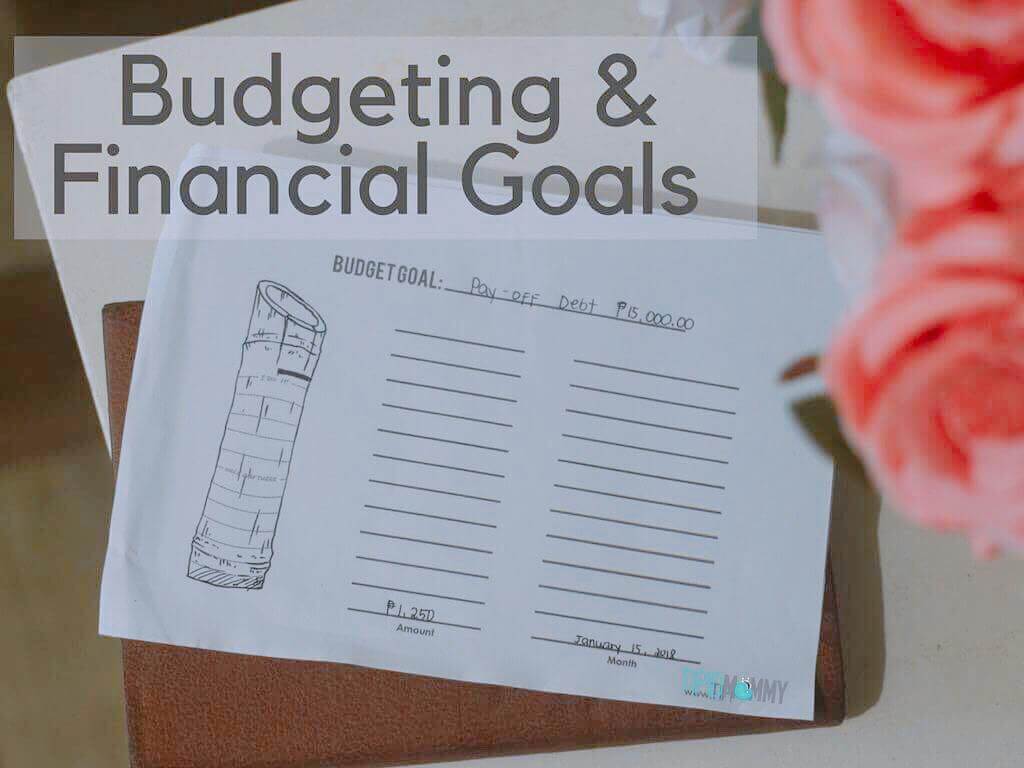

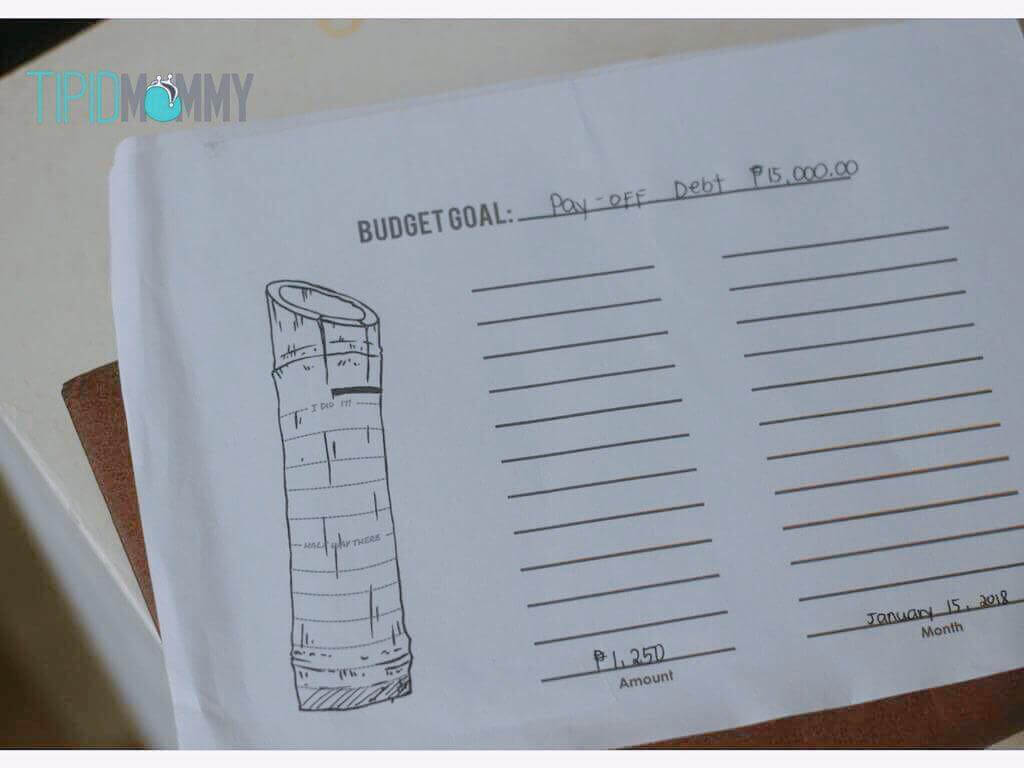

Here’s an example:

Myra and Johnny owed a relative P15,000 due to an emergency. (They do not have an emergency fund)

Myra & Johnny’s Goal for 2018 is to…

Pay-off P15,000 debt by December 15, 2018

From January 15, 2018- December 15, 2018

By setting aside P1,250.00/month, they can achieve their goal to pay off their debt by December 15, 2018.

The idea is, we can make small steps to achieve our big goals.

There are months during our season of debt, that I am honestly praying , for God to send us someone who can give us the amount that we need, but I’ve learned that God is teaching us so many things in that season, this is one of the lessons we’ve learned.

Take one small step at a time.

I also love this quote “God didn’t give us a dream that matches our budget…”

Indeed true, because sometimes when we compute our goals and dreams given by God, it looks so impossible in our current situation, but let’s not lose our hope.

What we can do in years, God can do in a second. In our family, we have “faith goals” these are goals that are impossible on our own but we’re entrusting God to answer if it is His will for our family.

This goal setting and budgeting format is just a guide. At the end of the day, it is still His plans that will prevail.

“For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it?”

Luke 14:28 ESV

Do you want a copy of this Budget Goal Printable? Send me a private message or just leave your email here 🙂

What about you? What’s your priority goal this year mommy?

The very same advice I would always hear from my mom. She would often tell us to save certain amount for the kids’ education and other needs.

I also refrain from borrowing money and instead, I save up for something I need.

Budgeting for the family has always been something I struggled in and I’ve been reading your blog ever since, and your tips deem useful in our lives <3 Thanks so much momma! Please share more budgeting tips, or maybe other techniques young moms like me need to know!

Yes to everything here! I always prepare a set budget whenever we want to do something (vacation, investment on our property, etc.). It really helps to have our goals backed up by numbers. Mas madaling ma-achieve.

I’m crazy about tracking! I track our spending and saving, too. Ika nga nila, what gets measured gets done. I apply that to my weight loss journey too haha!

While Maan is crazy about tracking, I’m just the opposite. Waaa! I need to learn how to track more. I’m just so not used to it!

Kaya mo yan mommy. Go go go!

Even my mother-in-law always tell us to save any amount to our bank monthly kasi eventually hindi natin mamamalayan, malaki na pala yung natatago namin. Thanks for sharing your tips sis! 🙂

Tara si MIL sis, small amount na consistent very helpful 🙂

I don’t think any family can survive without having a budget. It’s an unwritten law in family building.

Agree mommy.. kaya without a budget plan stressful talaga sa financial aspect ng family

As early as now, nagsasave na ko for Edmund’s school and other finances, indeed budgeting is the key to success and for you to have your ultimate dream- financial freedom. Avoid borrowing money and leaving within your means because if you live beyond your budget, yes, maganda nga marami kang updated na gadgets, travel everywhere and eat at expensive resto pero ang wallet mo 0 naman, wala rin.

I agree mommy in living within/below our means. Good job ka din sa pag-save sa school needs ni baby ng maaga 🙂

We are saving up for a vacation for next year and we’ve been doing that since last year.

Yay! Galing mommy!

We, mommies are really good when it comes to budgeting and we do it for the family. We prioritize everything for the family.

I agree, kahit magkano napapagkasya ng mga nanay 🙂

That “take one small step at a time” really works. Our goal is to save up more thru investment, setting a goal makes it easier for us to keep track and be mindful with our expenses. Setting a budget for everything truly makes it more manageable.

True, budgeting helps us manage our finances well 🙂

Hi! new reader here 🙂 and love reading your articles and tips 🙂

I’ve become more conscious with our finance this year (Money was certainly controlling me last year! 😛 haha!) and determine to keep it that way 🙂 I used to just buy anything, whatever and whenever. It’s a huge learning curve and I actually quite enjoy thinking of creative of ways or alternative things to use, eat etc

Keep up the great work! Looking forward for more saving tips!

Wow! go go go mommy!

Hi Mommy Gracie,

I want to have a copy of the free printables and how can I ordee your financial diary?

Hello please feel free to send me a message on my Facebook page mommy 🙂

Thank you.